Your Privacy

The Facts

01

Why?

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do.

02

What?

The types of personal information we collect and share depend on the product or service you have with us. This information can include: Social Security number, income and employment information, credit history and assets, and payment history, account balances and transaction history.

03

How?

All financial companies need to share customer’s personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customer’s personal information; the reasons we choose to share; and whether you can limit this sharing.

Sharing Your Information

PLEASE NOTE:

If you are a new customer, we can begin sharing your information 30 days from the date we sent this notice. When you are no longer our customer, we continue to share your information as described in this notice. However, you can contact us at any time to limit our sharing.

1. Download the form below:

2. Mail to us at:

theLender

25531 Commercentre #250 Lake Forest, CA 92630

You may also fill out, sign, and email this form to us at loanadministration@thelender.com. You may also fax copy of the completed form to 1-833-381-8733.

Questions

Email us at loanadministration@thelender.com, or call us toll-free at 1-833-381-8733.

| Reasons we can share your personal information | Does theLender share? | Can you limit his sharing? |

|---|---|---|

| For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | YES | NO |

| For our marketing purposes — to offer our products and services to you | YES | NO |

| For joint marketing with other financial companies | YES | NO |

| For our affiliates’ everyday business purposes — information about your transactions and experiences | YES | YES |

| For our affiliates’ everyday business purposes — information about your creditworthiness | YES | YES |

| For non-affiliates to market to you | YES | YES |

| For our affiliates to market to you | YES | YES |

theLender may disclose certain information to comply with regulatory requirements and legal processes, including court orders, subpoenas, search warrants, or other law enforcement requests.

What We Do

How does theLender protect my personal information?

To protect your personal information from unauthorized access and use, we use security measures that comply with applicable state and federal law. These measures include computer safeguards and secured files and buildings.

How does theLender collect my personal information?

We collect your personal information, for example, when you:

- Apply for a loan or provide employment information

- Pay your bills or pay insurance premiums

- Give us your contact information

We also collect your personal information from others, such as credit bureaus, affiliates, or other companies.

Why can’t I limit all sharing?

Federal law gives you the right to limit only:

- Sharing for affiliates’ everyday business purposes –information about your creditworthiness

- Affiliates from using your information to market to you

- Sharing for non-affiliates to market to you

State laws and individual companies may give you additional rights to limit sharing. See below for more on your rights under state law.

What happens when I limit sharing for an account I hold jointly with someone else?

Your choices will apply to everyone on your account.

Definitions

01

Affiliates

Companies related by common ownership or control. They can be financial and non financial companies.

Hometown Equity Mortgage, LLC dba theLender affiliates include certain financial and non-financial companies with the Hometown Equity Mortgage and theLender names such as insurance companies, a title agency, and a real estate services company.

02

Non-affiliates

Companies not related by common ownership or control. They can be financial and non financial companies.

Non-affiliates we share with can include direct marketing companies and mortgage companies.

03

Joint marketing

A formal agreement between non-affiliated financial companies that together market financial products or services to you.

Our joint marketing partners include companies such as credit life insurance issuers and home warranty companies.

Additional Important State & Other Information

IMPORTANT NOTICE ABOUT CREDIT REPORTING:

We may report information about your account(s) to credit bureaus and/or consumer reporting agencies. Late payments, missed payments, or other defaults on your account(s) may be reflected in your credit report and/or consumer report.

DO NOT CALL POLICY:

This Privacy Policy constitutes theLender’s Do Not Call Policy under the Telephone Consumer Protection Act for all consumers. We do not solicit via telephone numbers listed on the state or federal Do Not Call lists, unless the law allows. Consumers who ask not to receive telephone solicitations from theLender will be placed on the theLender Do Not Call list and will not be called in any future campaigns. If you communicate with us by telephone, we may monitor or record the call.

REVISION OF PRIVACY DISCLOSURES:

theLender may revise this Policy from time to time. All revisions of this Policy will be reflected on this web page, and will be effective upon publication. Your use of this Site is deemed acceptance of the Policy then in effect.

SPECIAL NOTICE FOR RESIDENTS OF VERMONT:

For Vermont Members/Customers: We will not disclose information about your creditworthiness to our affiliates and will not disclose your personal information, financial information, credit report, or health information to nonaffiliated third parties to market to you, other than as permitted by Vermont law, unless you authorize us to make those disclosures.

Additional information concerning our privacy policies can be found at http://www.theLender.com or call 833-381-8733.

SPECIAL NOTICE FOR RESIDENTS OF NEVADA:

We are providing you this notice pursuant to Nevada law. If you prefer not to receive marketing calls from us, you may be placed on our Internal Do Not Call List by calling 833-381-8733, or by writing to us at 25531 Commercentre #250, Lake Forest CA 92630. You may also contact the Nevada Attorney General’s office: Bureau of Consumer Protection, Office of Nevada Attorney General, 555 E. Washington St., Suite 3900, Las Vegas, NV 89101; Phone number 702.486.3132; email: BCPINFO@ag.state.nv.us

SPECIAL NOTICE FOR RESIDENTS OF CALIFORNIA:

CALIFORNIA PRIVACY NOTICE

This CCPA PRIVACY NOTICE is for California residents only and supplements the information contained in the Privacy Statement of Hometown Equity Mortgage, and its DBA; theLender (collectively, “we,” “us,” or “our”) and applies solely to visitors, client’s, users, and others who reside in the State of California (“consumers” or “you”). We adopt this notice to comply with the California Consumer Privacy Act of 2018 (“CCPA”) and other California privacy laws. Any terms defined in the CCPA have the same meaning when used in this notice.

Under CCPA, California residents have the right to know about information collected disclosed or sold, the right to opt out of the sale of certain information, and a limited right to have businesses delete information a business has collected about the consumer. These rights extend only to California residents and information covered by CCPA. Because CCPA does not cover all consumer data in all situations, only certain consumer data is subject to these rights.

Other laws may govern data we gather about you, or you provide to us including, but not limited to:

· Information to or from a consumer reporting agency if that information is to be reported in, or used to generate, a consumer report as defined by subdivision (d) of Section 1681a of Title 15 of the United States Code, and use of that information is limited by the federal Fair Credit Reporting Act (15 U.S.C. Sec. 1681 et seq.)

· Information collected, processed, sold, or disclosed pursuant to the federal Gramm–Leach–Bliley Act (Public Law 106–102), and implementing regulations, or the California Financial Information Privacy Act (Division 1.4 (commencing with Section 4050) of the Financial Code). PLEASE NOTE: Any personal data collected in relation to a mortgage loan is exempt from the consumer rights to know, delete and opt-out created under CCPA because this information is governed by the Gramm-Leach-Bliley Act, the Fair Credit Reporting Act, the California Financial Information Privacy Act or other state and federal laws which exempt this data from CCPA.

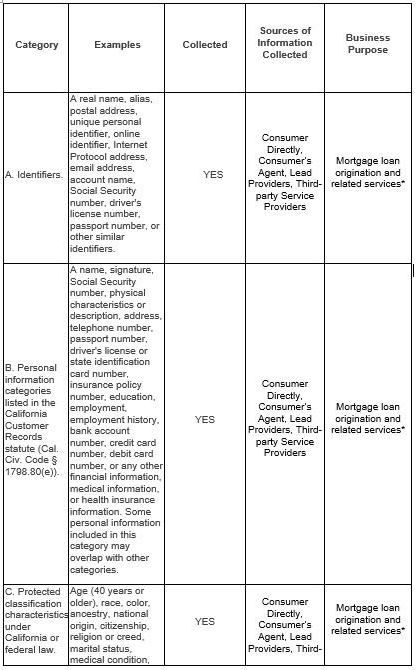

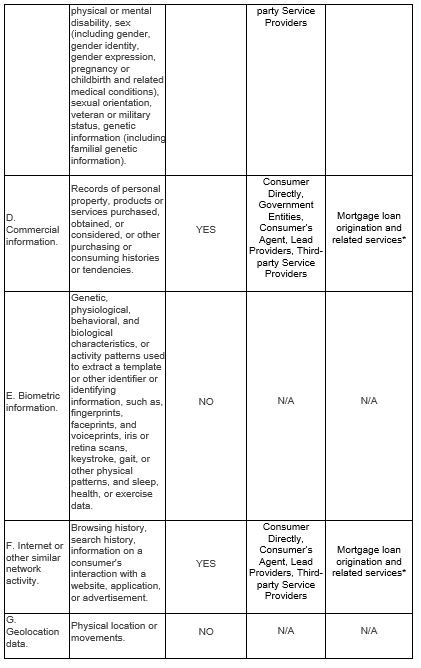

Information We Collect

Hometown Equity Mortgage (“Company” or “we”) collects information that identifies, relates to, describes, references, is capable of being associated with, or could reasonably be linked, directly or indirectly, with a particular consumer or device (“Personal Information”). As described above, not all of the Personal Information collected below is subject to CCPA. All Personal Information collected pursuant to this notice that is subject to CCPA is collected for a Business Purpose and may be shared with service providers if necessary to perform a Business Purpose. We may have collected the following categories of personal information from consumers within the last 12 months:

* Related services may include, but are not limited to real estate services, loan underwriting, insurance, escrow and other closing services, notary, appraisal, other consumer credit services, home warranty, and other services related to home purchase, home ownership, or related consumer transactions.

RIGHTS UNDER CCPA

The CCPA provides consumers (California residents) with specific rights regarding their personal information. This section describes your CCPA rights and explains how to exercise those rights.

Right to Know About Personal Information Collected, Disclosed, or Sold. California consumers have the right to request that a business disclose what personal information it collects, uses, discloses, and sells over the past 12 months.

Right to Request Deletion of Personal Information. Under CCPA, you may have the right to request the deletion of your personal information collected or maintained by the Company subject to certain exceptions.

Right to Opt-Out of the Sale of Personal Information. Under CCPA, you may have the right to opt-out of the sale of their personal information by a business. Note that as defined in CCPA, the Company does not, and will not, sell your personal information.

Right to Non-Discrimination for the Exercise of a Consumer’s Privacy Rights. Under CCPA, you have the right not to receive discriminatory treatment by the Company for the exercise of the privacy rights conferred by the CCPA.

Instructions for Exercising Rights to Know, Opt-Out, and Deletion Rights

To submit a verifiable consumer request to exercise the above-mentioned rights, you must either email us at Compliance@theLender.com, or call us toll-free at 1-833-381-8733

After submitting a request, we will verify your identity by matching the identifying information provided by you to the personal information already maintained by us, or, in cases where your request requires a higher degree of certainty, we may use a third-party identity verification service or ask for a photo ID or for more information. Any information you provide us that is not already in our system will be deleted after your request has been fulfilled.

The verifiable consumer request must:

· Provide sufficient information that allows us to reasonably verify you are the person about whom we collected personal information or an authorized representative.

· Describe your request with sufficient detail that allows us to properly understand, evaluate, and respond to it.

We cannot respond to your request or provide you with personal information if we cannot verify your identity or authority to make the request and confirm the personal information relates to you. Making a verifiable consumer request does not require you to create an account with us. We will only use personal information provided in a verifiable consumer request to verify the requestor’s identity or authority to make the request. Our practices with regard to verifying a request will vary depending on the request and the information we have on the person making the request.

Authorized Agents

Only you or a person registered with the California Secretary of State that you authorize to act on your behalf, may make a verifiable consumer request related to your personal information. You may also make a verifiable consumer request on behalf of your minor child.

If you use an authorized agent to submit a request to know or a request to delete, you must provide the Company with written permission from you giving the authorized agent permission to submit the request on your behalf, and you may be required to verify the authorized agent’s identity with the Company. The Company may deny a request from an agent that does not submit proof that they have been authorized by the consumer to act on their behalf.

Changes to Our Privacy Notice

We reserve the right to amend this privacy notice at our discretion and at any time. When we make changes to this privacy notice, we will notify you by email or through a notice on our website homepage.

Additional Information

If you have any questions or comments about this notice, our Privacy Statement, the ways in which we collect and use your personal information, your choices and rights regarding such use, or wish to exercise your rights under California law, please do not hesitate to contact us at: Compliance@theLender.com, or call us toll-free at 1-833-381-8733.